News

The latest company news, industry trends, and relevant articles.

Check Fraud Is Rising—and Technology Debt Is Making It Worse for Community Banks

Community banks have always played a unique role in the financial ecosystem. Built on trust, longstanding relationships, and deep local knowledge, they serve customers in ways large institutions often cannot. But even with those strengths, today’s operating environment is changing fast—and deposits and payments are at the center of that change.

Exploding Check Fraud

The title of this article is taken from a recent webinar offered by the KBA. These three words are an apt description of what banks, particularly community banks, are facing today. FINCEN recently reported that SARs filed on check fraud increased by nearly 500% over five years, while the number of checks written today is only 20% of what it was 30 years ago.

Fraud Trends and Technology: 5 Trends to Watch in 2026

Fraud continued to challenge financial institutions in 2025, and technology was a deciding factor in the fight against it. Entering the New Year, we are in the midst of an era of change in fraud prevention, including rapid technology adoption and new fraud detection requirements.

Why Positive Pay Is the Best Defense Against Check Fraud in 2026

Check fraud continues to evolve — from stolen and altered checks to counterfeit and unauthorized payments — putting businesses of all sizes at risk of financial loss and operational disruption. A 2025 NPG report shows that a majority of companies using Positive Pay report reduced fraud attempts or losses, making it a cornerstone of business fraud prevention strategies in 2026.

We Can’t Give Up Paper Checks, and That’s a Gold Mine for Scammers

Americans can’t quit paper checks. Fraudsters are cashing in. A message appeared this month on an app where people often congregate to trade tips on committing check fraud. It named some of the largest banks: “TD. PNC. CITI. NOWWWWW.”

Federal Reserve Financial Services Financial Institution Risk Officer Survey (2023)

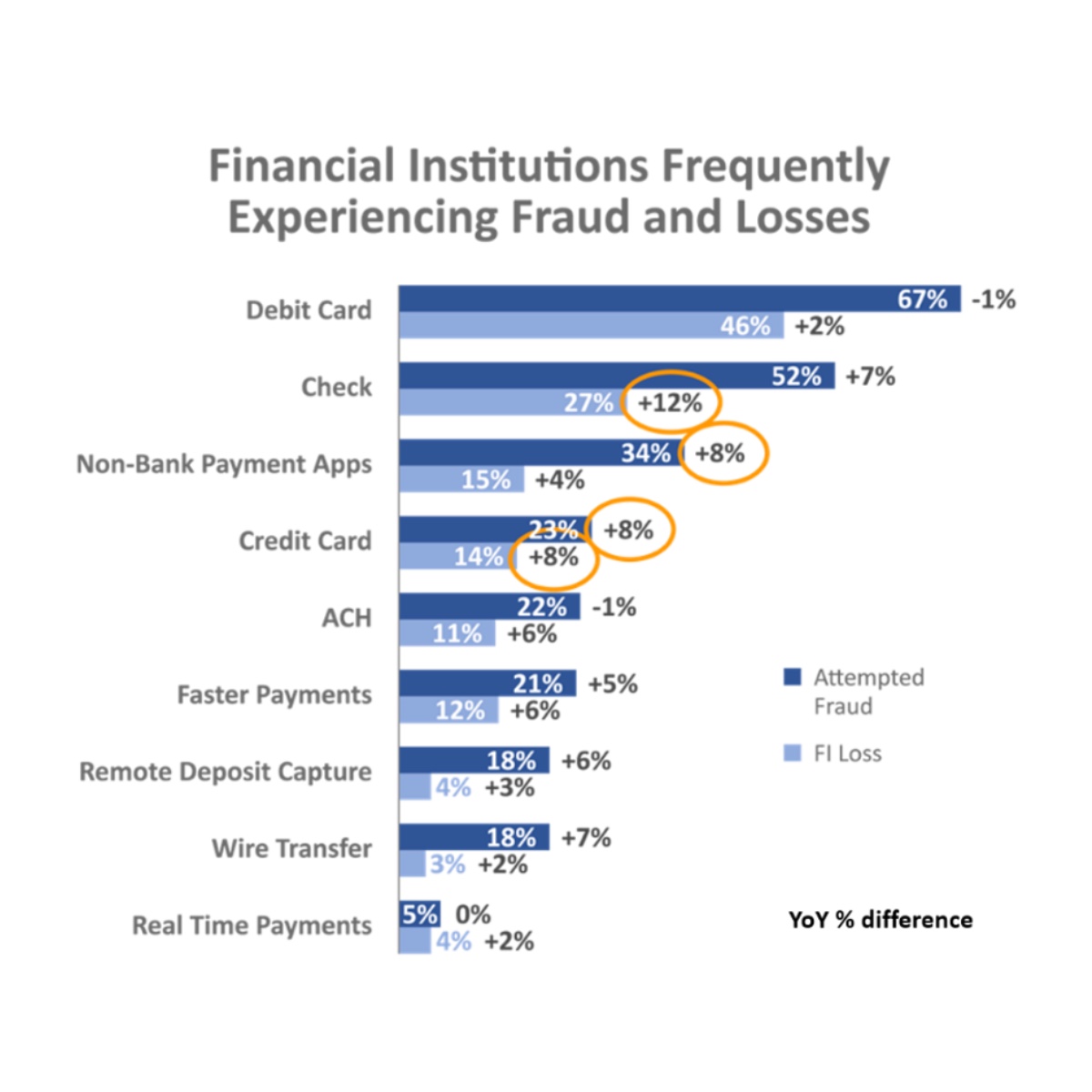

In 2023, like 2022, external fraud remained the top operational risk. Survey responders cited concerns with increased fraud with check, card and non-bank apps, as well as increasing mule activity. Largest year-over-year increase in financial institutions (FIs) experiencing losses

were in check, followed by credit card.

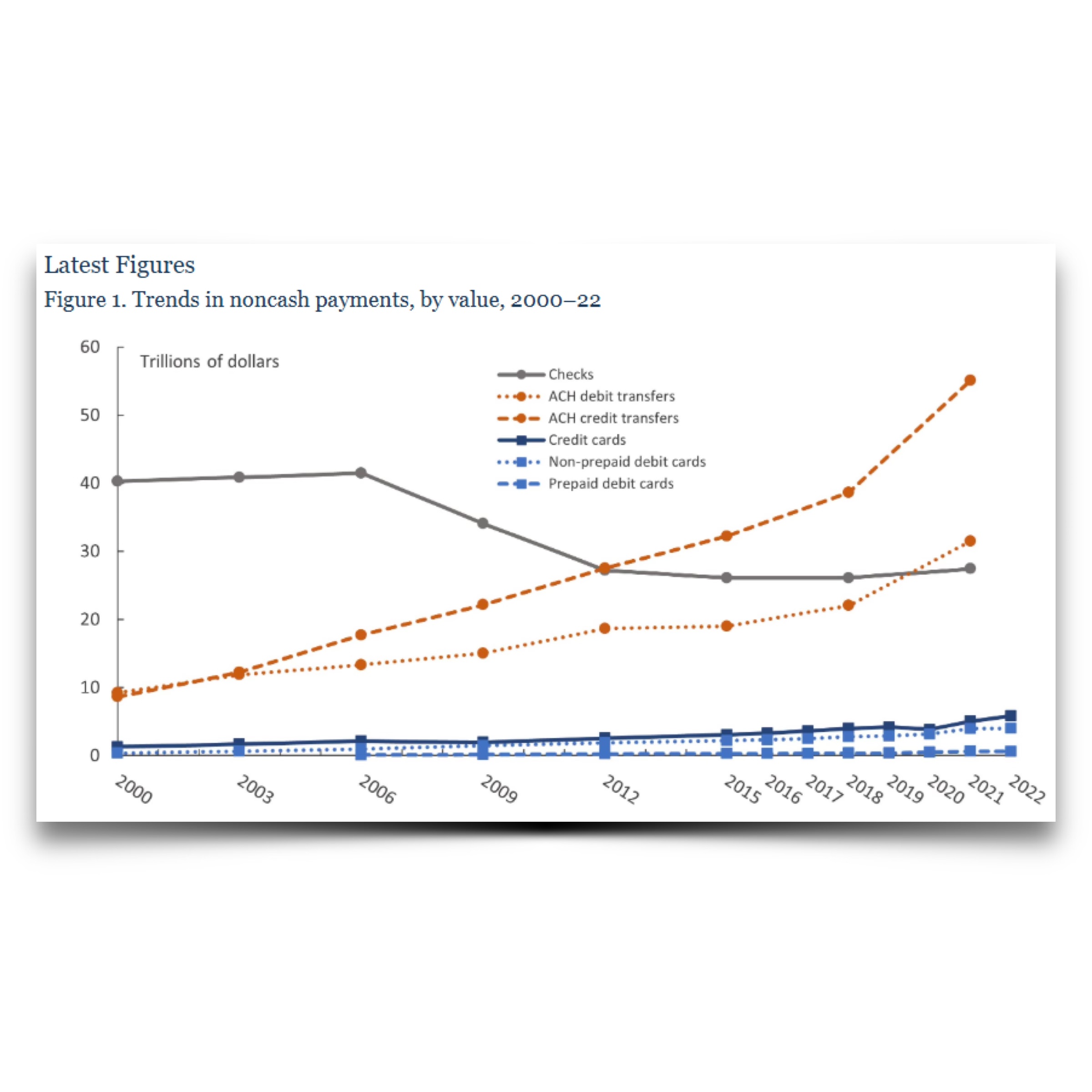

Federal Reserve Payments Study (FRPS) - March 2025

ACH, Checks, Wires, and Alternative Payments.

Data included in this release is from the DFIPS, which include a consistent set of large depository institutions and a representative sample of smaller institutions.

Mobile deposits carry higher fraud risk

Some estimates indicate that processing traditional paper checks can cost anywhere from $4 to $20 per transaction in hidden fees.

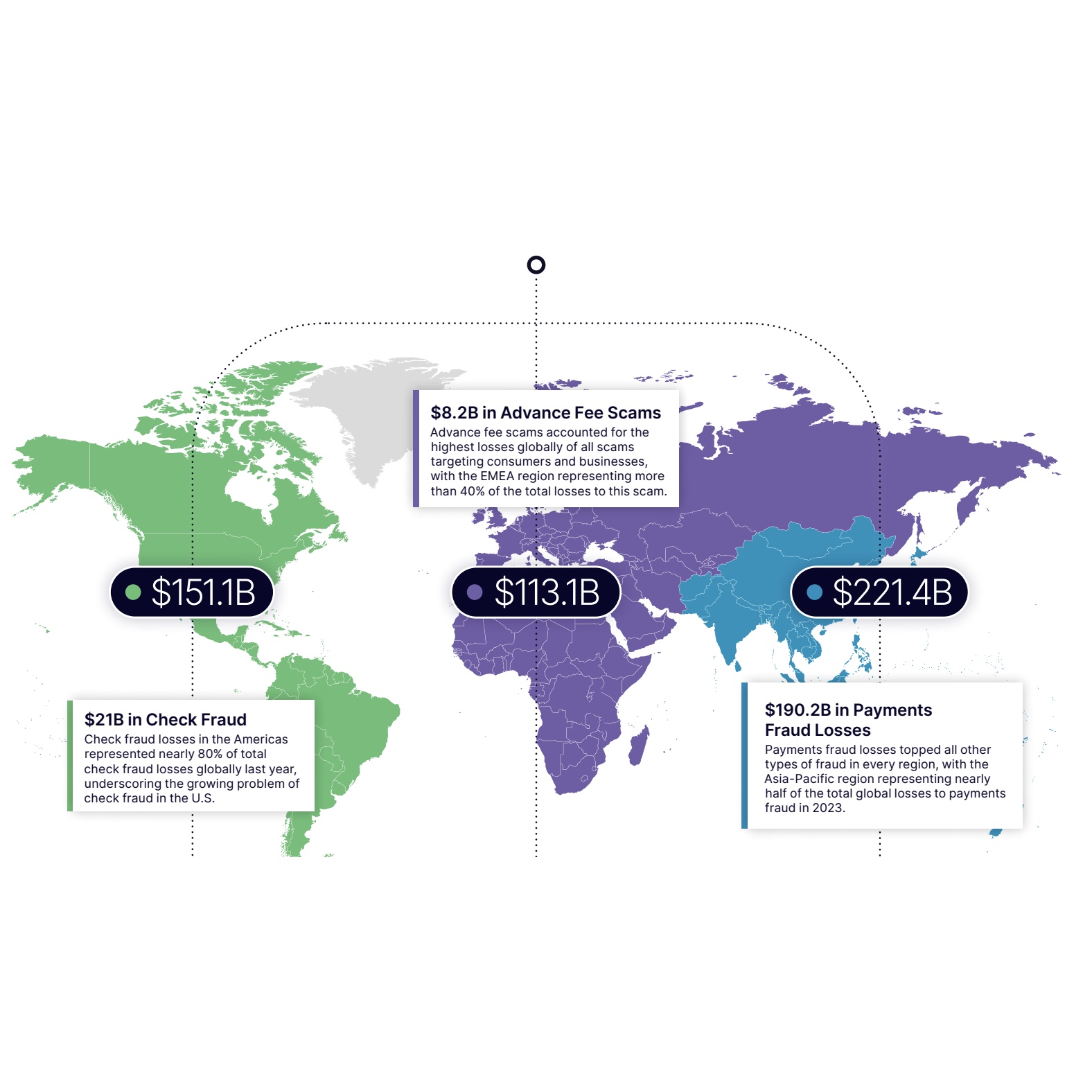

Nasdaq: Global Financial Crime Report

Nasdaq reports that check fraud losses in the Americas totaled $21 billion in 2023 and represented nearly 80% of total check fraud losses globally, underscoring the growing problem of check fraud in the U.S.

Check Fraud Running Rampant in 2023

Report finds that deposit volume increased by 2.6% year-over-year from 2021 to 2022, while at the same time fraud volume has increased by 62%, meaning there was a 58% increase in fraud rate from 2.09 BPS in 2021 to 3.31 BPS in 2022.

Banks on High Alert as Check Fraud Threatens New Deposits

Frank McKenna, chief fraud strategist at Point Predictive, estimates that check fraud will reach at least $24 billion or more in 2023, up 50% from 2018’s levels.

Cases of check fraud escalate dramatically, with Americans warned not to mail checks if possible

Americans wrote roughly 3.4 billion checks in 2022, in the average amount of $2,652.

Back with a vengeance: The challenges of check fraud

Financial Crime Enforcement Network reports over 680,000 Suspicious Activity Reports of potential check fraud in 2022, up from 350,000 in 2021

Banks Beware: Mobile Checking and the Rise of Duplicate Presentment

UCC Law Journal article outlines the limitations of existing legal structures to address check fraud in the digital age and why a technological solution is necessary.

Check Deposit Fraud Increased 385% in 2022

Benchmarking data collected by Auriemma Roundtables finds that check fraud increased by 385% in 2022.

Western And Lake Check Cashers LLC v Propane Pete LLC

2023 Illinois Court of Appeals opinion holds that check cashing service is “holder in due course” of check that had previously been deposited through mobile app, making drawer of check liable for payment twice.